Reflecting on market performance…

Last week the equity turnover experienced cyclical movements driven primarily but not solely by foreign participation. Large capitalization stocks experienced the greatest volatility. The NASI was fairly stable during the week as the N20 experienced a reversal in gains made mid through the week. All in all, last week proved that the economy was fairly stable. (Market performance below)

| Monday, April 25, 2016 | Tuesday, April 26, 2016 | Wednesday, April 27, 2016 | Thursday, April 28, 2016 | Friday, April 29, 2016 | |

| Equity+I Reit Turnover (KES) | -62% | 192% | -50% | 52% | -40% |

| Total Volume Traded | -61% | 119% | -26% | 71% | 109% |

| Market Cap (KES) | -1% | 0% | 0% | 1% | 0% |

| Bond Turnover | 5716% | 65% | -19% | -26% | -70% |

| NSE 20 share Index | 0% | 0% | 24% | -20% | 0% |

| NSE All share Index | -1% | 0% | 0% | 1% | 0% |

| FTSE NSE Kenya 15 index | 0% | 0% | 0% | 1% | 0% |

| FTSE NSE Kenya 25 index | -1% | 0% | 0% | 1% | 0% |

| FTSE NSE Kenya Govt. Bond Index | 0% | 0% | -1% | 1% | -100% |

| Foreign buys | -74% | 276% | -39% | 36% | -52% |

| Foreign sales | -84% | 951% | -51% | 37% | -43% |

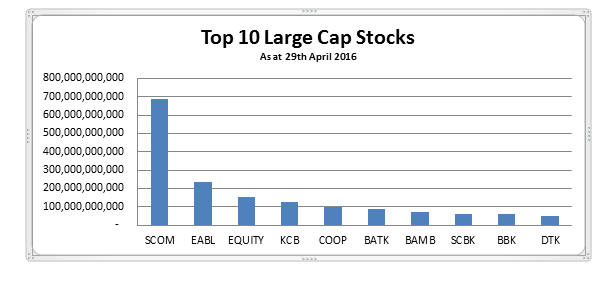

Large Cap Stocks

As at the end of April 2016, stocks in the banking sector had the highest proportion in the top 10 large capitalization stocks accounting for 60% of the total number. This continues to signal the importance of the banking sector and thus any shocks that affect that market could have a huge impact on the Kenyan market through the different stock market indices.

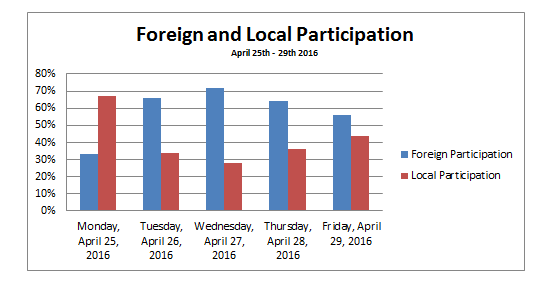

Foreign and Local Participation

Foreign participation is on average above 50% each week making it an important indicator to follow as foreign investors contribute a significant proportion to market moves in terms of total equity turnover.

During the last week of April, there was excess foreign supply in the market as net buys stood at Ksh 218,460,890 while net sales stood at Ksh 264,639,140.

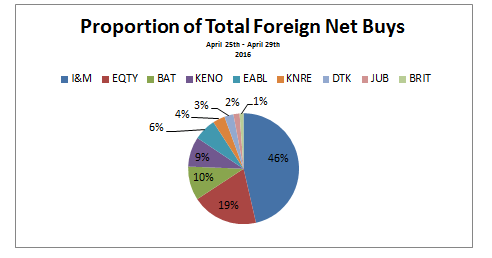

Foreign Buys

Foreign inflows were greatly seen in the banking and insurance industry with foreign darlings BATK and EABL experiencing continued ‘support’ from foreigners. KenolKobil may have benefited from the optimistic outlook in the oil industry as oil prices continue to rise.

I&M continues to enjoy foreign buys after it was announced that CDC Group is seeking to purchase a 10.68% stake in the company through a private share transfer. To note, I&M is also looking to acquire Giro Commercial Bank and they have also been authorized to purchase a 65% stake in Burbidge Capital which is a corporate advisory firm.

My assumption is that foreigners are looking to exploit the current low stock prices in the banking and insurance industry as the market is on its way to recovery from the very tough year in 2015. As can be seen below, all counters have not hit highs previously realized during the past year. This is a signal to investors that stock prices have the potential of reaching previous highs (and of course lows) and thus may be considered ‘cheap’.

| Past Week | Past Year | |||

| Ksh | High | Low | High | Low |

| I&M | 111 | 107 | 139 | 95 |

| EQTY | 40 | 40 | 51 | 36.5 |

| BAT | 849 | 824 | 869 | 670 |

| KENO | 10.9 | 10.45 | 11.6 | 7.55 |

| EABL | 297 | 279 | 340 | 245 |

| KNRE | 19.95 | 19.45 | 22.75 | 15.45 |

| DTK | 205 | 190 | 244 | 176 |

| JUB | 475 | 470 | 600 | 384 |

| BRIT | 13.25 | 13.05 | 27 | 10 |

| BAMB | 189 | 174 | 200 | 135 |

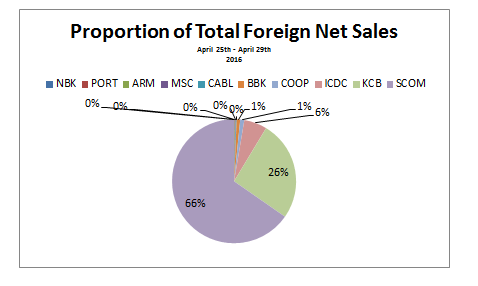

Foreign Sales

Foreign outflows were primarily noted in the Safaricom and KCB counters. These counters are normally the most traded in the market (together with Equity) and thus considered the most liquid. This is particularly true for large volume trades.

Shareholder Returns

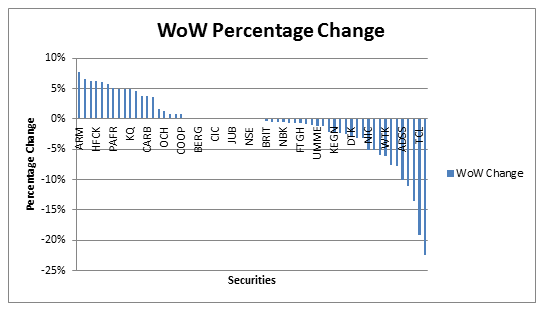

ARM gained 8% week-on-week on the back of improved investor sentiment with the possible new investor in British development finance group CDC Group. They are set to get $140 million from the new investor which will come in the form of new equity thus diluting existing current shareholding. $110 million will go into retiring existing debt while $30 million will go into CAPEX. Last week, ARM announced a pretax loss of Ksh 3.54 billion due to unrealized foreign exchange losses and rising finance costs. This is a company to watch this week as investors have mixed emotions towards the bad news from the financials and the positive news from the expected capital injection.

On the other end of the spectrum, Standard Chartered Bank shed 22% in its share price as investor confidence dwindled on the back of its removal from the NSE 20 Share Price Index. The London based parent company is undergoing a major restructuring process as it continues to work on creating banking efficiency with the use of technology and also focusing on business that it can and has a competitive advantage in. To note, the company looks to lay off a total of 15,000 employees across its subsidiaries by 2018 and currently in Kenya, 167 employees have been laid off.

The manufacturing industry experienced the highest number of counters offering investors positive week on week returns.