The services sector and private consumption represent the backbone of Kenya’s economy.

The services sector, which accounts for nearly half of the nation’s GDP includes businesses in trade, lodging, food, transportation, storage, ICT, financial services, real estate, education, and health etc.

In addition to the services sector’s importance to the economic momentum, the growth of the services sector has significant direct effects on job creation and exports/investment inflows.

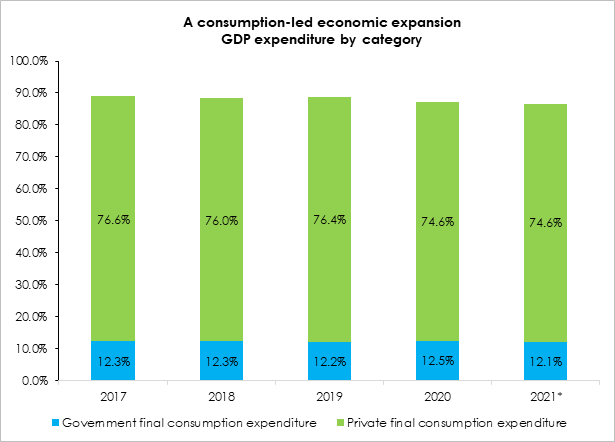

When viewing GDP from an expenditure perspective by decomposing the major actors of spending, private consumption comes out on top, accounting for nearly 70 percent of GDP.

Given that private consumption is assumed to be the primary component of aggregate demand, it is a crucial metric that policymakers examine as an indicator of the economic health of households.

Easing credit conditions and a robust labor market have remained the primary factors that have supported private consumption growth.

This is significant because it has heavily influenced the new administration’s “bottom-up approach”, which is agreeably grounded in economic theory.

The government seeks to strengthen the labor market, reduce credit costs, and expand access to financing.

Further support to the private sector has come from the central bank. Recently, the central bank has endeavored to revitalize the private sector through the Credit Repair Framework, which aims to improve the credit standing of eligible mobile phone digital borrowers by offering them a 50 percent discount on outstanding loans if the remaining balance is repaid by March 2023.